Brewers Association Releases Top 50 Producing Craft Brewing Companies for 2023

The Brewers Association (BA)—the trade association representing small and independent American craft brewers1 — released its annual production figures for the U.S. craft brewing industry.2 The results are a bit mixed with more openings than closings and more employees in craft beer, but producing less beer at the same time.

According to the BA, the number of operating craft breweries continued to climb in 2023, reaching an all-time high of 9,683, including 2,071 microbreweries, 3,467 brewpubs, 3,900 taproom breweries, and 245 regional craft breweries. The total U.S. operating brewery count was 9,812, up from 9,730 in 2022. This past year there were 495 new brewery openings and 418 closings. Openings decreased for a second consecutive year, with the trend reflecting a more mature market. The closing rate increased in 2023 but continued to remain relatively low, at approximately 4%.

The craft beer industry also hired more employees this past year. As brewery count increased and a continued shift to hospitality-focused business models, craft brewers directly employed 191,421 people in 2023. This marks a 1.1% increase in 2023 from 2022.

“2023 was another competitive and challenging year for small and independent brewers,” said Bart Watson, vice president of strategy and chief economist of the Brewers Association. “Nevertheless, even as growth has downshifted, small brewers have proved quite resilient, as seen in the increase in number of breweries, relatively low closing rates, and gains in onsite sales and jobs.”

Collectively, small and independent brewers produced 23.4 million barrels of beer in 2023, a decline of 1.0% from 20223, though craft’s overall beer market share by volume grew to 13.3%, up from 13.1% in 2022 as craft’s declines were smaller than overall beer volume losses.

The overall beer market* shrank 5.1% by volume in 2023. Retail dollar value was estimated at $28.6 billion, representing a 24.5% market share and 3% growth over a comparable value in 2022. Sales growth was stronger than volume primarily due to pricing but also due to slightly stronger onsite sales growth versus distribution.

“As always, the beverage alcohol market and consumer demand continue to evolve,” added Watson. ”Many brewers are accordingly updating their operations to match those changes, focusing on their business models, go-to-market strategies, and brand strategies to help their businesses match those shifts.”

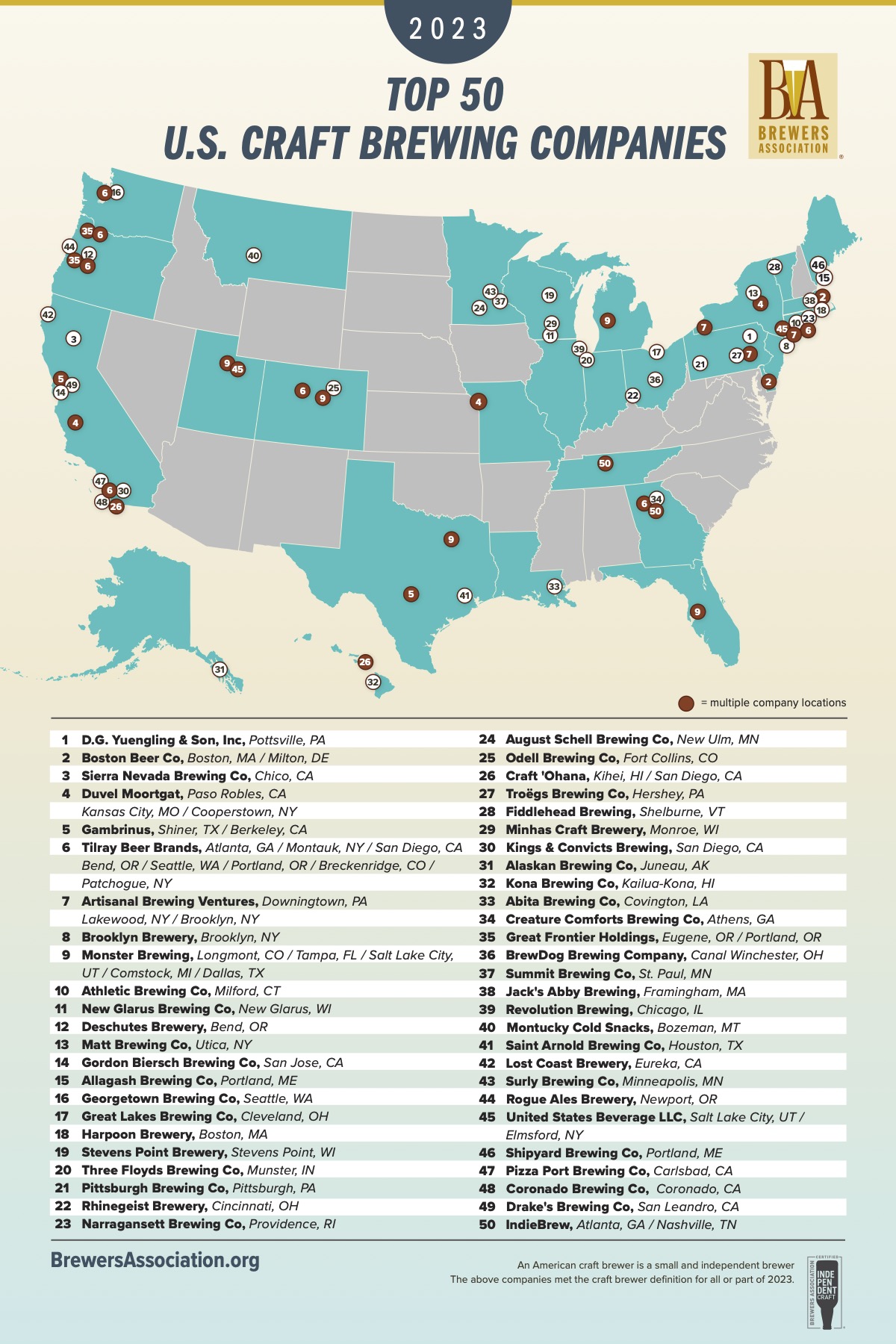

In addition, the Brewers Association also released its annual list of the top 50 producing craft brewing companies and overall brewing companies in the U.S., based on beer sales volume. Of the top 50 overall brewing companies in 2023, 40 were small and independent craft brewing companies.4

Within this list of the top 50 producing craft brewing companies, there are a few that have operations in the Pacific Northwest. The acquisition by Tilray Beer Brands of many of the former craft brands from Anheuser Busch that includes 10 Barrel Brewing, Widmer Brothers Brewing, and Redhook Brewery placed this fast growing brewery in the #6 spot. Other ranked PNW breweries include Deschutes Brewery at #12, Georgetown Brewing Co. #16, Alaskan Brewing Co. at #31, Great Frontier Holdings (Ninkasi Brewing and Ecliptic Brewing) at #35, and Rogue Ales Brewery at #44.

Top 50 Craft Brewing Companies

- D. G. Yuengling and Son Inc

- Boston Beer Co

- Sierra Nevada Brewing Co

- Duvel Moortgat USA

- Gambrinus

- Tilray Beer Brands

- Artisanal Brewing Ventures

- Brooklyn Brewery

- Monster Brewing

- Athletic Brewing Company

- New Glarus Brewing Co

- Deschutes Brewery

- Matt Brewing Co

- Gordon Biersch Brewing Co

- Allagash Brewing Company

- Georgetown Brewing Co

- Great Lakes Brewing Company

- Harpoon Brewery

- Stevens Point Brewery

- Three Floyds Brewing

- Pittsburgh Brewing Co

- Rhinegeist Brewery

- Narragansett Brewing Co

- August Schell Brewing Company

- Odell Brewing Co

- Craft ‘Ohana (Maui/Modern Times)

- Troegs Brewing Co

- Fiddlehead Brewing

- Minhas Craft Brewery

- Kings & Convicts Brewing

- Alaskan Brewing Co.

- Kona Brewing Hawaii

- Abita Brewing Co

- Creature Comforts Brewing Co.

- Great Frontier Holdings

- BrewDog Brewing Co

- Summit Brewing CoS

- Jack’s Abby Brewing, LLC

- Revolution Brewing

- Montucky Cold Snacks

- Saint Arnold Brewing Co

- Lost Coast Brewery

- Surly Brewing Company

- Rogue Ales Brewery

- United States Beverage LLC

- Shipyard Brewing Co

- Pizza Port

- Coronado Brewing Co

- Drake’s Brewing Co

- IndieBrew

“While distribution is as competitive as ever, we continue to see success stories and pockets of growth across the top 50 list,” said Watson. “Even in an era of slow growth, the strongest brands still resonate with beer drinkers, regardless of company size or location.”

Note: Numbers are preliminary. For additional insights from Bart Watson, visit Insights & Analysis on the Brewers Association website. The full 2023 industry analysis will be published in the May/June 2024 issue of The New Brewer, highlighting regional trends and production by individual breweries.

* Does not include FMBs/FSBs. With those included, total taxed-as-beer products decreased 5%.

1An American craft brewer is a small and independent brewer. Small: Annual production of 6 million barrels of beer or less (approximately 3% of U.S. annual sales). Beer production is attributed to a brewer according to the rules of alternating proprietorships. Independent: Less than 25% of the craft brewery is owned or controlled (or equivalent economic interest) by a beverage alcohol industry member that is not itself a craft brewer. Brewer: Holds a Brewer’s Notice issued by the Alcohol & Tobacco Tax & Trade Bureau, or its successor, or control the intellectual property for one or more brands of beer, has that brand or brands brewed for it in the United States, and have as its primary business purpose the resale of the brand or brands it controls.

2Absolute figures reflect the dynamic craft brewer data set as specified by the craft brewer definition. Growth numbers are presented on a comparable basis.

3Volume by craft brewers represents total taxable production.

4Figure based on companies that met the craft brewer definition for all or part of 2023.

About The Author

DJ

D.J. is a Portland, Oregon based writer that spent his formative years in the Midwest. With over 25 years under his belt of drinking beer at festivals across America and the world, he has developed a strong appreciation and understanding of craft beer and the industry that surrounds it. He can be found in any of the great breweries or beer bars that make Portland the best beer city in the world. His writing can also be found in the archives of Northwest Brewing News and can be followed on Twitter and Instagram at @hopapalooza.